Missouri Food Pantry Tax Credit

This material has been prepared for information purposes only and is not intended to provide or relied on for tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors regarding your filing of the Missouri Food Pantry Tax Credit.

What is the Missouri Food Pantry Tax Credit?

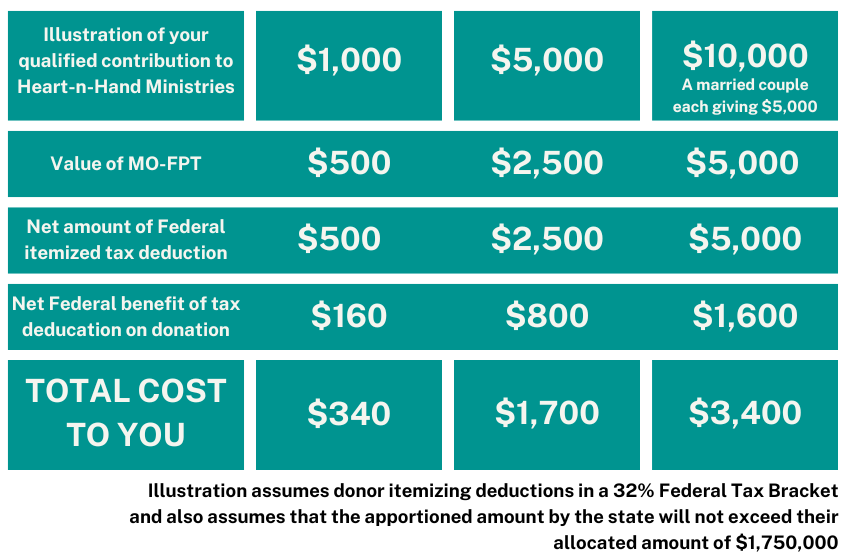

This program incentivizes Missouri taxpayers to donate to food pantries by offering a state tax credit of up to 50% of their gift back. This means that if you donate up to $5,000, you can receive up to $2,500 back in a state tax credit and can be used over three years of tax liability. In-kind donations, stock donations, and gifts from Donor Advised Funds do not qualify for the credit but cash / check / or online donations are eligible.

This program incentivizes Missouri taxpayers to donate to food pantries by offering a state tax credit of up to 50% of their gift back. This means that if you donate up to $5,000, you can receive up to $2,500 back in a state tax credit and can be used over three years of tax liability. In-kind donations, stock donations, and gifts from Donor Advised Funds do not qualify for the credit but cash / check / or online donations are eligible.

How do I claim the Food Pantry Tax Credit?

You'll need to attach the following to your Missouri tax return:

A completed Miscellaneous Income Tax Credits Form (MO-TC) - this will be filled out by the donor themselves or their tax preparer

A completed Food Pantry Tax Credit Form (MO-FPT) - this will be filled out mostly by the food pantry (see details on how to request your MO-FPT form from Heart-n-Hand below).

You'll need to attach the following to your Missouri tax return:

A completed Miscellaneous Income Tax Credits Form (MO-TC) - this will be filled out by the donor themselves or their tax preparer

A completed Food Pantry Tax Credit Form (MO-FPT) - this will be filled out mostly by the food pantry (see details on how to request your MO-FPT form from Heart-n-Hand below).

Am I guaranteed the MFPTC?

The State of Missouri apportions $1,750,000 into the MFPTC program each year. MFPTC claims will be held by the Missouri Department of Revenue until after all returns received on April 15 have been processed to determine if the total amount claimed exceeds $1,750,000. If claims exceed $1,750,000, the Department will apportion credits in an equal ratio among all valid returns filed. Any remaining credit from an applicant can be applied to future tax years.

Unfortunately, the state is very strict on filing deadlines. You must file your 2023 Missouri taxes by April 15, 2024, in order to be eligible for the credit. If you file them later, you will be eligible to apply the tax credit to a future tax year

The State of Missouri apportions $1,750,000 into the MFPTC program each year. MFPTC claims will be held by the Missouri Department of Revenue until after all returns received on April 15 have been processed to determine if the total amount claimed exceeds $1,750,000. If claims exceed $1,750,000, the Department will apportion credits in an equal ratio among all valid returns filed. Any remaining credit from an applicant can be applied to future tax years.

Unfortunately, the state is very strict on filing deadlines. You must file your 2023 Missouri taxes by April 15, 2024, in order to be eligible for the credit. If you file them later, you will be eligible to apply the tax credit to a future tax year

Missouri Department of Revenue Information:

This site will be helpful in previewing information directly from the MO Dept of Rev regarding the tax credit. It goes over eligible food pantries (the HNH Food Pantry is eligible), how to claim the food pantry, how to use the tax credit, due dates, funding limits, and more directly from the State. Click here to see the tax credit information from the state. You may also call the Missouri Taxation Division at (573) 751-3220 or e-mail: [email protected] (They are extremely helpful!)

This site will be helpful in previewing information directly from the MO Dept of Rev regarding the tax credit. It goes over eligible food pantries (the HNH Food Pantry is eligible), how to claim the food pantry, how to use the tax credit, due dates, funding limits, and more directly from the State. Click here to see the tax credit information from the state. You may also call the Missouri Taxation Division at (573) 751-3220 or e-mail: [email protected] (They are extremely helpful!)

Our Process:

Not every donor will want or need to take advantage of the Missouri Food Pantry Tax Credit so HNH will not automatically send these forms out to donors. To request a MO-FTP for your contributions, fill out the request form below and our office will send you a completed MO-FTP. You will still have to fill out the top portion of the form with your specific taxpayer details. You can also call us at (816) 322-1133

Not every donor will want or need to take advantage of the Missouri Food Pantry Tax Credit so HNH will not automatically send these forms out to donors. To request a MO-FTP for your contributions, fill out the request form below and our office will send you a completed MO-FTP. You will still have to fill out the top portion of the form with your specific taxpayer details. You can also call us at (816) 322-1133

All gifts received by year-end may be eligible for the credit. If you are a Missouri resident that wants to receive a tax form in the mail from HNH, please request one using the form below and expect a turn around time of 2-3 weeks. We will email you a digital version of the form so indicate in the comment section if you'd prefer a mailed version.